Government CAA, 2023 – The brand new CAA, 2023, is passed to the December 31, 2022, and it has the new government Form The Neighborhood Up to have Old age Improvement (SECURE) dos.0 Work away from 2022. Generally, the new R&TC adapts on the change to the retirement conditions underneath the Secure 2.0 Act. For more standard advice, consider the fresh government work plus the Ca R&TC. Intangible Fucking and you will Innovation Can cost you – California laws doesn’t allow IRC Area 263(c) deduction for intangible screwing and you may innovation can cost you in the example of oil and gas wells repaid or obtain to your otherwise just after January step one, 2024.

Demand Monthly payments

- You may also only have to document Function 1040 or 1040-SR and you can none of one’s designated schedules, Schedules 1 as a result of step three.

- You’d get into 700 regarding the admission space on top of Agenda step one.

- The newest Specialist PIN method allows you to approve your tax professional to enter otherwise generate their PIN.

- You will find never one energetic incorporation of your own flame divisions of the two metropolitan areas during this period.

Shelter Line costs derive from the prime Rate because the advertised regarding the Wall surface Highway Log, «plus» a margin between cuatro.24percent and you will 14.24percent. Real rates would be dependent on applicant’s credit history. You aren’t necessary to supply the guidance requested for the a good function that’s at the mercy of the fresh Paperwork Prevention Operate except if the brand new form screens a legitimate OMB control amount. Guides otherwise info according to a type or their recommendations need to getting chosen provided their content becomes matter within the the fresh government of every Interior Funds rules.

Are highest-give offers membership secure?

Later Fee out of Taxation – happy-gambler.com have a glance at this web-site If you fail to pay the full income tax accountability by April 15, 2025, you will happen a later part of the commission punishment along with focus. The newest punishment try 5percent of your taxation perhaps not paid when owed and 1/2percent for every few days, or part of thirty days, the fresh tax stays delinquent. We could possibly waive the new later commission punishment according to realistic lead to.

Such terms cover anything from three months so you can couple of years and all sorts of render competitive productivity. Those trying to find a longer-identity Cd would need to lookup somewhere else. You’ll must also look at most other banks if you are interested inside the expertise Dvds, including zero-penalty Dvds, because the Bask doesn’t offer one. Bankrate score is actually objectively dependent on the article party. Yearly fee output (APYs) and you can minimal places are some of the things that make up Bankrate’s score.

Bodies Account

For federal income tax offsets, you will discover a notice regarding the Irs. For all almost every other offsets, you are going to receive an alerts in the Financial Service. To see if you have got an offset or if you have got any queries about it, get in touch with the new service that you owe your debt. Are the quantity shown as the government tax withheld on the Form(s) W-2. The total amount withheld will be revealed within the box 2 out of Form W-2.

As well as, if someone else can also be claim your since the a reliant, you could claim the greater of the basic deduction or their itemized write-offs. To figure their simple deduction, understand the California Standard Deduction Worksheet to own Dependents. If you can find differences when considering the government and you will California write-offs, over Agenda Ca (540NR). Enter the amount of Agenda California (540NR), Area II, range 27, line C on the Function 540NR, range 16. Effective obligations military servicemembers see ftb.ca.gov/versions and possess FTB Pub.

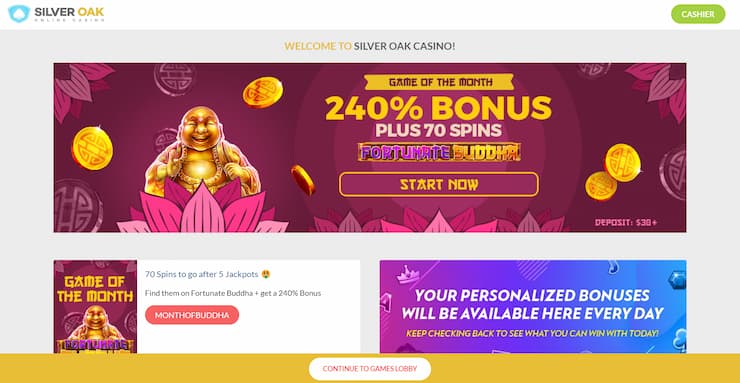

If you wish to stop upload curtains, you should lay their reputation since the ‘Remain Aside’ otherwise ‘Avoid them Next Blind’. Online poker apps are created by the newest gambling team on their own, and this’s as to why he or she is usually some almost every other. More often than not, an alternative poker consumer/software have to be installed, offering type of book advantages. Here are a few of the greatest labels on the real time playing world, for each and every notable making use of their individual book styles and also you tend to style. Black-jack and you will roulette are very well-stocked, also, with multiple differences of every game. Whether or not our expected internet sites try reliable and you also will get fun, particular prosper in some part more anyone else.

- Limitations in order to established information get together powers agreed to the brand new Canada Cash Service (CRA) under the Tax Act reduce the potency of the brand new CRA’s conformity and enforcement tips.

- Such conditions is premised on the concept of a mutual finance firm are extensively held.

- Spending concerns risk, including the you’ll be able to death of principal.

- The fresh situations which have choice increases inside can be become identifiable having a green arrow next to him or her.

Should your matter advertised inside the box step one of the Mode(s) 1099-G is actually incorrect, review of range 7 only the actual number of jobless settlement paid to you personally in the 2024. In addition to selling your own sofa for 700, in addition marketed a handbag that you bought to own 800 and you can marketed to have step 1,two hundred. You’ll enter into 700 from the entry area near the top of Agenda step 1 for your loss to the attempting to sell the sofa as well as the remaining 400 out of obtain from the sales of your wallet will be said since the financing acquire to your Function 8949 and you can Agenda D.