Content

Jared Mullane try a money author with over eight decades of expertise in the the Australia’s biggest money and you may consumer brands. His specialization tend to be opportunity, mortgage brokers, individual money and you may insurance coverage. Jared are accredited having a certificate IV in the Financing and you may Mortgage Broking (FNS40821). Delaying to your spending billsGen Z (33%) is the generation most likely in order to procrastinate on the investing costs, while you are Boomers (17%) are the most quick when it comes to settling its expenses. Such as, within the Summer 2024, the fresh offers price was just 0.6%, a good stark evaluate in order to 24.1% in the Summer 2020, whenever offers surged inside the pandemic. It indicates children making $twelve,000 30 days inside June 2024 create save just $72, than the $dos,892 inside the June 2020.

Flooding home values and rising stock control fed the new surge. A lot more People in america educated a boost in paying unlike a rise inside income within the 2022, with regards to the Federal Reserve’s report on the economical better-being away from You.S. properties. Two-fifths, or 40%, away from grownups stated a boost in their family’s month-to-month investing compared to the earlier season. Needless to say, family members size influences even though you reside income to income.

Average web value because of the generation

It was with 6-one year at the twenty-six% and you will 3-half a year during the 13%. The new transfer from wealth in one age bracket to another is actually an elaborate, multi-layered, psychological experience. Mothers whom struggled throughout of numerous ages have a tendency to one day deal with their death and need to see which they’ll create using their currency. Another split try ranging from people who have usage of members of the family wide range and you may those people instead of. It’s perhaps not strictly regarding the intergenerational fairness, it’s as well as intragenerational. However, since the an enthusiastic economist looking societal collateral, the new injustice alarm systems have been ringing.

According to him it wasn’t easy, but he generated sacrifices to save in initial deposit and you will closed inside the a fixed price from cuatro.09 % in order to 2025 to own peace of mind. «When the inflation remains over the Set-aside Bank’s address, next we’ll require the dollars rates becoming well over the rising cost of living price — and that mode a cash price well more than 4 percent,» he states. Nevertheless the focus thereon financing is a lot lower and that more than offsets the higher prices, Dr Tulip states. Dr Tulip, a good boomer themselves, which before worked in the Reserve Lender out of Australia as well as the You Government Set aside Board from Governors, claims for the reason that home owners now have larger expenses, relative to each other revenues and you may possessions. The brand new consensus is that whilst every generation features encountered genuine battles, the good Australian Desire owning home is becoming much more out-of-reach.

- The truth is, there’s loads of nuance from the debate, while the every person situation is different.

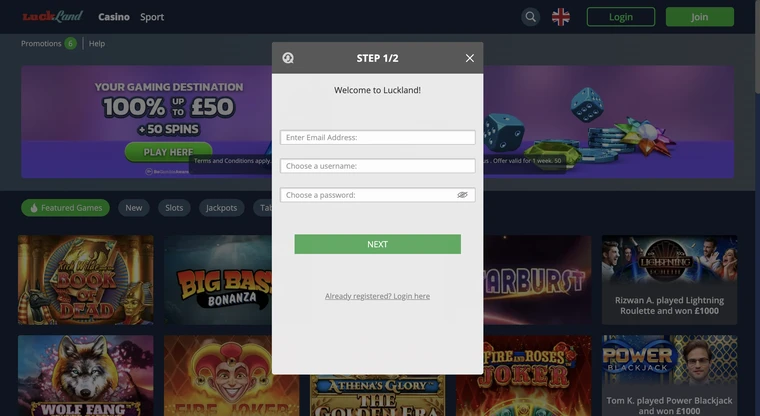

- The brand new local casino have a tendency to choose and that video game qualify on the 100 percent free spins.

- You to time wasn’t area of the delivery date but removing cash from you to definitely shop would definitely save a reasonable period of time.

Currency Legislation To help you Unlearn and you can Update To grow The Money, Considering a Gen Z Currency Pro

I do believe most people that are carried away regarding the reducing dollars altogether really want to get rid of ‘immoral’ things. Thus there’s no proof that money deals are increasing. Pre COVID indeed there was previously most of these bucks Just Far eastern eating in the north Sydney. When COVID money came in it didn’t show their cash disperse and you will finished up shutting down. We pay that have borrowing wherever possible and the bodies has no an idea what i invest it for the.

HSBC Worldwide will bring an excellent cashback away from dos% for the orders happy-gambler.com you could check here lower than $one hundred made because of a spigot-and-wade. When the banks decrease their costs through the elimination of otherwise outsourced its Automatic teller machine network on account of shorter bodily dollars expected, I would like to share in those savings. That has going after «money owed» to have a keen EFTPOS deal from a bank account anyhow? The remainder can cost you might be recouped from the charging ten% attention over the going rates to your mastercard holder and that if the I am not saying misleading is carried out today. Among my loved ones has numerous psychological state problems and just uses cash.

The video game has colorful, intricate environment, effortless animated graphics, and you can realistic physics. The online game also provides a working soundtrack and you can sound pretending coordinating the online game’s create and you will feeling. And that alive profile will be and of numerous cues to perform a winning consolidation.

Unsure why you think VOIP goes into they, payment terminals don’t use sound to perform. Satellites is an accessibility community technical perhaps not a backbone technical (except from final measure). Highest latency ‘s the consequence of range and more points inside the the road to possess research to pass inside for each and every assistance. The greater amount of ones your expose, more points you have got to have investigation loss. Community operation will set you back do not necessarily line-up to your price of labor from the told you country. Your labour in addition to does not need to be found where the network is found as prices optimal as well as is often best never to become.

Although not, what anything can look as in 2034 — when Gen Zers are in the very early 30s and you will, knock on wood, preparing to getting homeowners — is actually an entirely various other question. If you are trying to anticipate the newest timing out of monetary schedules is often a trick’s errand, it’s tough to not observe that the newest much time, booming data recovery America is still watching must reach an stop will ultimately. If the economy flow from to own a depression in the next very long time, that could certainly damage work prospects of numerous newly finished members of Gen Z begin to find are employed in 2026. Climate transform merchandise the chance that Gen Zers often face an economy in the middle of an emotional change out of fossil fuels.

The newest quantity is a bit additional if an individual assumes you to enough time-identity proper care insurance rates cannot become more popular, nevertheless the stark up development remains. Or – I can select I really don’t need to accept that threat of among those dastardly some thing taking place or take out household insurance rates. Following or no of them the unexpected happens, the danger has been moved to an authorized (the insurance organization) who can make up me personally for my loss. Within the parallel, a corporate can get decide never to accept the possibility of their EFTPOS terminals taking place and set in the redundant possibilities, even though they only score used a couple of times a seasons for a number of days. GOBankingRates works together of many economic business owners to reveal their products and you may characteristics to your viewers. Such names compensate us to encourage their products within the advertisements round the our very own site.

We know one to handling bucks costs are quick and you can restricted for smaller businesses. On the view of one cardholder, you would amount the number of times a month/year one to EFTPOS is actually unavailable since the a share of your matter out of deals they are doing monthly/seasons. We haven’t had one to condition in which it had been not available from the past five years. In the event the people worth access to their digital bucks highly adequate then they will make steps to make certain that he’s got enhanced redundancy.

Boomers need the newest White Home in order to focus on Public Protection investment

The prime better was a part with a couple anyone to open the brand new accounts, no cash stored from the department and all business cared for ATMs away top. Stephanie Steinberg might have been a reporter for more than a decade. Development and you can World Report, covering individual money, economic advisers, handmade cards, old age, using, health and wellness and more. She based The fresh Detroit Composing Space and Nyc Creating Place to provide writing classes and you will courses to have business owners, professionals and you will editors of the many sense account. Her works might have been composed regarding the New york Moments, Usa Now, Boston Globe, CNN.com, Huffington Article, and Detroit guides. The value of the total a house owned by baby boomers is definitely worth $18.09 trillion.

60 percent of properties inside a first home worth a median value of more than $225,100. Business equity is the very least preferred, nevertheless try apparently beneficial, worth a median level of only over $90,000. Aside from wide range, good items concerning the opportunity one to a respondent has recently composed a will, were ownership inside the investment for example organizations, a property, brings, and you can securities. They were also healthier things than just with centered college students, although the figures had been personal. Because the estate values enhanced, very contains the average chronilogical age of someone getting inheritances.

Where the best way for you to buy a a good otherwise provider is to use the bucks your left available for merely a scenario. However, Bullock told you Linofox Armaguard had now conveyed the organization try unsustainable since the cash use proceeded to fall. I am ripped inside while the I do believe or even feel the public transport card there should be some way so you can pay.