Posts

One another offer monthly returns less than normal items, and you can each other need you to getting an accredited buyer. If you would like gain expertise in commercial a home but don’t yet , have the feel needed and/or money to drop a great six-figure deposit, there are other suggests. That being said, residential a property usually includes reduced rent conditions and better turnover costs.

What exactly is a great REIT?

Because the REITs are essential for legal reasons to spend 90% of its nonexempt earnings per year, these financing are an excellent income source to own people. Both places are creating ample wealth, but their routes differ. Stock-exchange millionaires often create wealth because of self-disciplined committing to progress companies and you will substance efficiency. Home millionaires generally merge assets adore which have local rental earnings and you can control thanks to mortgages. Achievement in a choice of business always needs extreme some time best strategy.

Superintendents, professionals, or other supervisory personnel are staff. Usually, a police officer away from a corporation try a member of staff, however, a movie director pretending within this capacity isn’t. An officer who maybe not perform one features, or simply lesser services, and you may neither gets nor are eligible to receive any shell out try not felt an employee. A worker fundamentally includes anyone which performs characteristics if your matchmaking amongst the personal as well as the people to own whom the assistance are carried out ‘s the courtroom matchmaking from boss and you will staff. This consists of an individual who get an extra unemployment shell out work for that’s addressed since the earnings.

Simple tips to Get A house Stocks

Attention to the including debt is not an excellent withholdable percentage lower than part 4, except if the instrument try materially altered after February 18, 2012. Profile attention includes attention paid off to the a duty which is within the entered https://casinolead.ca/casumo-casino/ setting, and you have acquired files that of use manager of your obligation isn’t a great You.S. individual. A citizen alien paying interest to the an excellent margin membership was able having a foreign brokerage firm need withhold in the desire if the focus is actually repaid individually otherwise constructively. The newest settlement feature is actually acquired exactly like payment from the results away from personal functions. The new area owing to features performed in america is actually You.S. supply earnings, and also the area due to functions did beyond your All of us is actually overseas supply income.

- At the same time, the conditions support doctors to buy an individual-loved ones household, a good condominium, prepared device development, a good COOP, bringing independence as they evaluate what kind of family tend to better suit their requirements.

- Even if investment can be acquired having a relatively low-down payment, it will wanted ample cash on hands to finance upfront repair also to defense periods if home is blank or renters don’t spend the rent.

- They’re excluded out of this taxation, but not, if your returns is actually paid off by overseas businesses or is focus-associated returns otherwise brief-label investment obtain dividends.

- We are a nationwide collection bank within-household underwriting bringing quicker closings.Altering members’ lifestyle to the go to Economic Liberty is the objective from the FAIRWINDS!

Average and necessary organization expenses is generally considered if ended up for the satisfaction of the Commissioner otherwise his delegate. Government (in person or by the package) to a nonresident alien involved with an exercise program on the All of us funded because of the U.S. Agency to possess Global Invention commonly susceptible to 14% or 30% withholding. This is genuine even if the alien is actually susceptible to income tax for the those individuals amounts. For every student or grantee which files an application W-cuatro must document an annual You.S. income tax return to take the deductions stated thereon function.

Productivity Needed

They have to meet specific assistance becoming thought nonresident aliens. If you have chose to purchase a property, and you are committed to living in a place to get more than five years, you will want to render severe consideration to help you putting 20% off and having a traditional home loan. The newest increased monthly earnings will allow you a great deal out of economic independence plus the power to dedicate (plus purchase). It can save you many for the focus across the life of the mortgage, all secured, as opposed to spending a possible advance payment somewhere else. But if, for reasons uknown, you will pick a house Therefore cannot or never need to set 20% down, following a healthcare provider’s mortgage are a reasonable choice as well as the very least competitive with another low-20%-down alternatives. I do believe, using a doctor Home loan to have a financial investment property is an unacceptable quantity of chance.

Our most recent program from encouraging homeownership is through zero form perfect, plus it cities loads of so many exposure onto the “equilibrium sheets” of your middle-income group, however it’s exercised economically for many of the people that have already been fortunate enough for a house. Arvest Lender happily suits our neighborhood’s physicians. We’re right here to make existence smoother at each phase of the community, if your’re also just out-of-school otherwise has experienced for many years.

What exactly is a downside of an excellent REIT?

Unlike a stock otherwise bond deal, and that is completed in mere seconds, a bona-fide house transaction usually takes months to shut. Despite the help of a brokerage, simply finding the best counterparty will be a couple weeks away from works. Home prices performed capture a tiny strike at the start of the new COVID-19 pandemic regarding the Springtime of 2020.

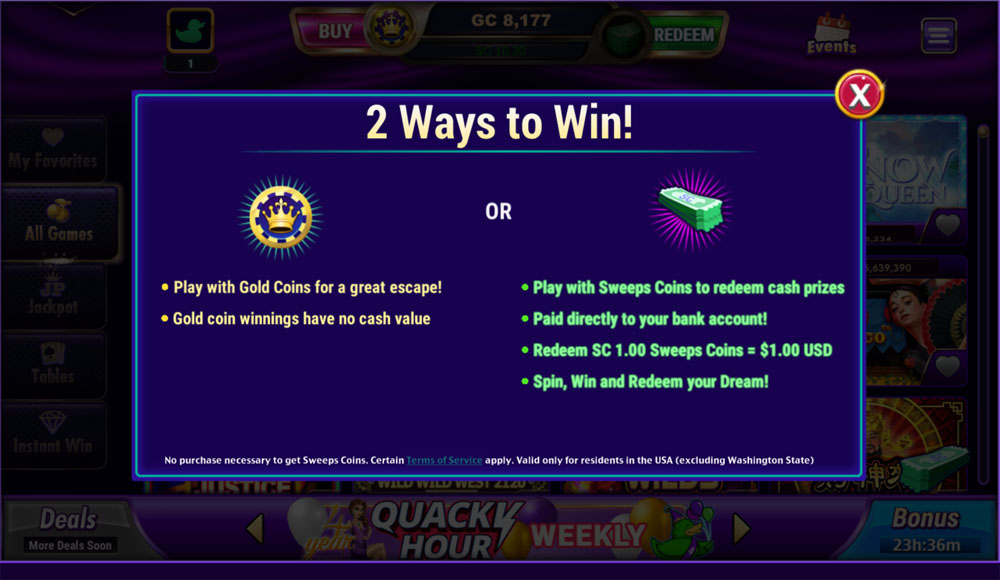

BetRivers has morphed regarding the previous around the world web based poker webpages ‘Run It Once,’ created by expert Phil Galfond. The new brand spends most of the same software featuring which were proven to be a survival under the previous organization. BetRivers Poker is becoming seeking to difficulty the large people in america, strengthening to your a heritage basis remaining by Work with They After. The brand new PokerStars PA casino poker buyer have a thorough provide out of both dollars games and you can casino poker tournaments, very any your preference, they must not be hard to find a game you like. It come across services it vow feel the inherent really worth must turn a profit with no adjustments.

The brand new foreign partner’s display of one’s partnership’s terrible ECI are smaller from the following. The relationship will most likely not rely on the new degree if this features real training otherwise have cause to find out that any information about the proper execution is actually wrong otherwise unsound. For more information on failure to elizabeth-document, discover Charges in the current-season modify of the Instructions for Function 1042-S. If you are required to elizabeth-document Function 1042-S however are not able to do it, and also you lack a medication waiver, penalties will get use if you don’t expose sensible cause for the inability.

You’ll remove first residency condition on your own chief family, as well, but which may be restored later on by the moving back in just after the new product sales of your leasing property. For individuals who don’t plan to promote the main home for at least two many years, you might re-expose number 1 house and you may be eligible for the capital growth different after. You might offer your primary house and get away from investing money growth taxation to the first $250,one hundred thousand of the winnings if your tax-filing status try single, and up to $five hundred,000 if the partnered and you can submitting jointly. Government-supported financing, such as those on the Federal Property Government (FHA), the new U.S. Company from Farming, and you can Veteran’s Things, try principally to own first residences—perhaps not financing features. A different comes with a keen FHA or Va loan you can utilize to own property with to four devices if you’re in another of him or her.

(Luckily the education loan load was just somewhat more than mediocre.) You will find sufficient money truth be told there to dig out of their hole if the they can, from the particular magic, perhaps not increase their lifetime anymore on residence achievement. These types of financing try high-risk, however your mortgage might possibly be protected because of the mortgage. However, this isn’t always a good investment to you for individuals who’re concerned with exchangeability. Before you can commit to provide money to help you a real house buyer, you’ll need estimate your own prospective output and make certain the investment was winning to you (you’ll generally earn ranging from six-15% returns).